Countries around the world have endured over a year of extreme uncertainty in the context of the COVID-19 crisis, and economies in the Caribbean have suffered more than most. But with the increasing availability of vaccines and prospects for a resumption of international travel, light is emerging at the end of the Pandemic tunnel. With this in mind, The Inter-American Development Bank Caribbean Department’s most recent Quarterly Bulletin reviews the latest available information regarding the crisis’ impacts on citizens, their economies, and key factors that will determine the speed and depth of recovery. As also discussed in previous editions, prospects for tourism-dependent economies will depend heavily on vaccine penetration and border normalization in source countries—particularly the United States and the United Kingdom—, while commodity-intensive economies could benefit from upward revisions to global demand growth estimates. All countries in the region can do much to support a rapid recovery through forward-looking policies aimed at ensuring they are well positioned to take advantage of post-Pandemic preferences with respect to travel and tourism, services trade, and investment. Our latest report considers these issues, what may lie ahead, and how countries can best position themselves for a recovery in 2021 and beyond.

Caribbean economies are the world’s most dependent on tourism…

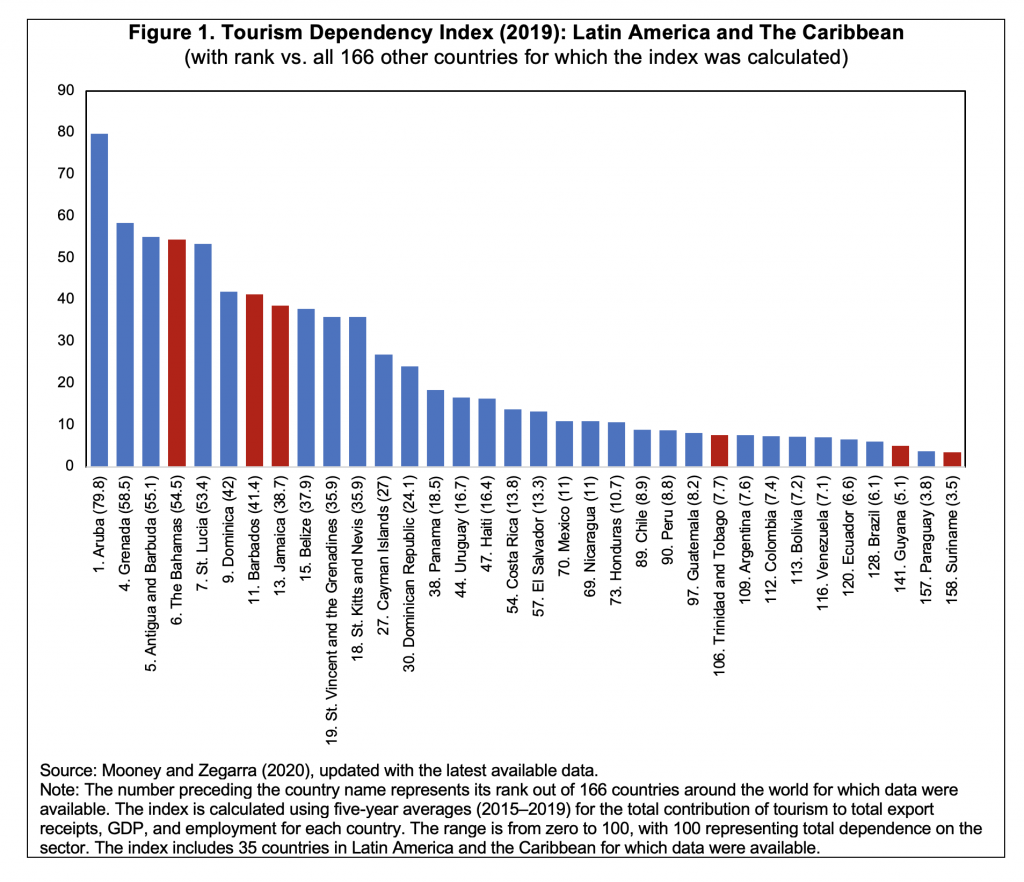

A year ago, as the novel coronavirus spread, borders closed, and social distancing measures were implemented, our Caribbean economics team began trying to understand the potential economic and social implications for the region. Commodity-oriented economies began to suffer from the decline in prices, particularly oil and gas. But the most worrisome sector was tourism, and so the focus was on trying to understand how tourism-based economies would fare. Our early simulations of potential output losses seemed hard to fathom at the time, as they implied historic declines in GDP for many of our member countries. Unfortunately, as many of our worst fears materialized, we developed a new understanding of just how important the sector really is for Caribbean economies—see our updated Tourism Dependency Index, that ranks over 160 countries globally in terms of economic reliance on tourism for GDP, employment, and exports (Figure 1).

A year like no other…

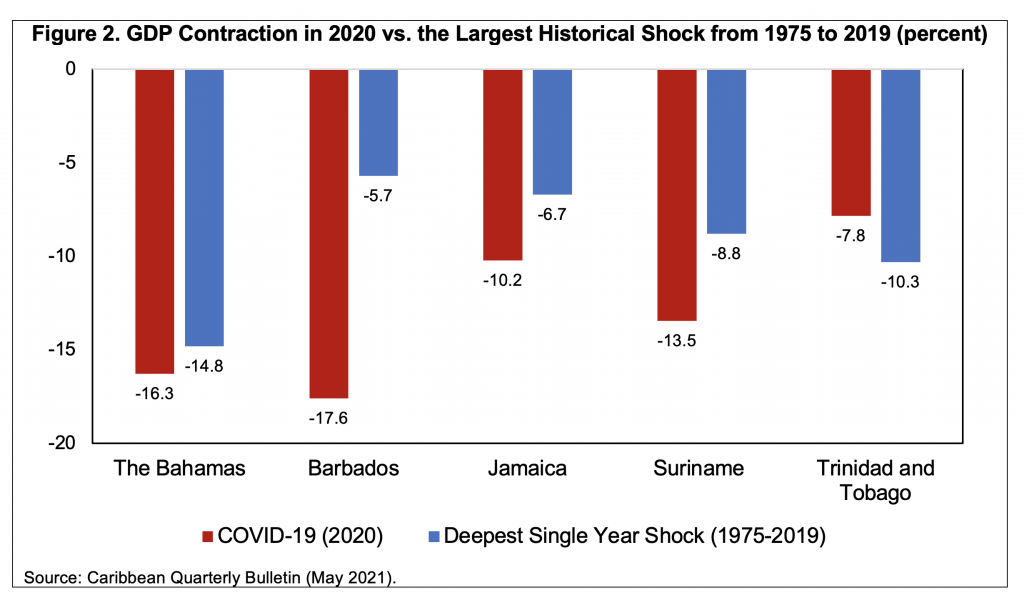

The COVID-19 pandemic represents a new kind of economic shock for countries in the region. The human toll of the pandemic has been tragically high, and this has been its most significant implication. But the crisis has also affected key sectors of the region’s economies with a speed and persistence that few could have imagined only a year ago. One reflection of this has been the shock to real GDP growth in 2020, which represented the largest decline in most of our countries since 1975 (Figure 2).

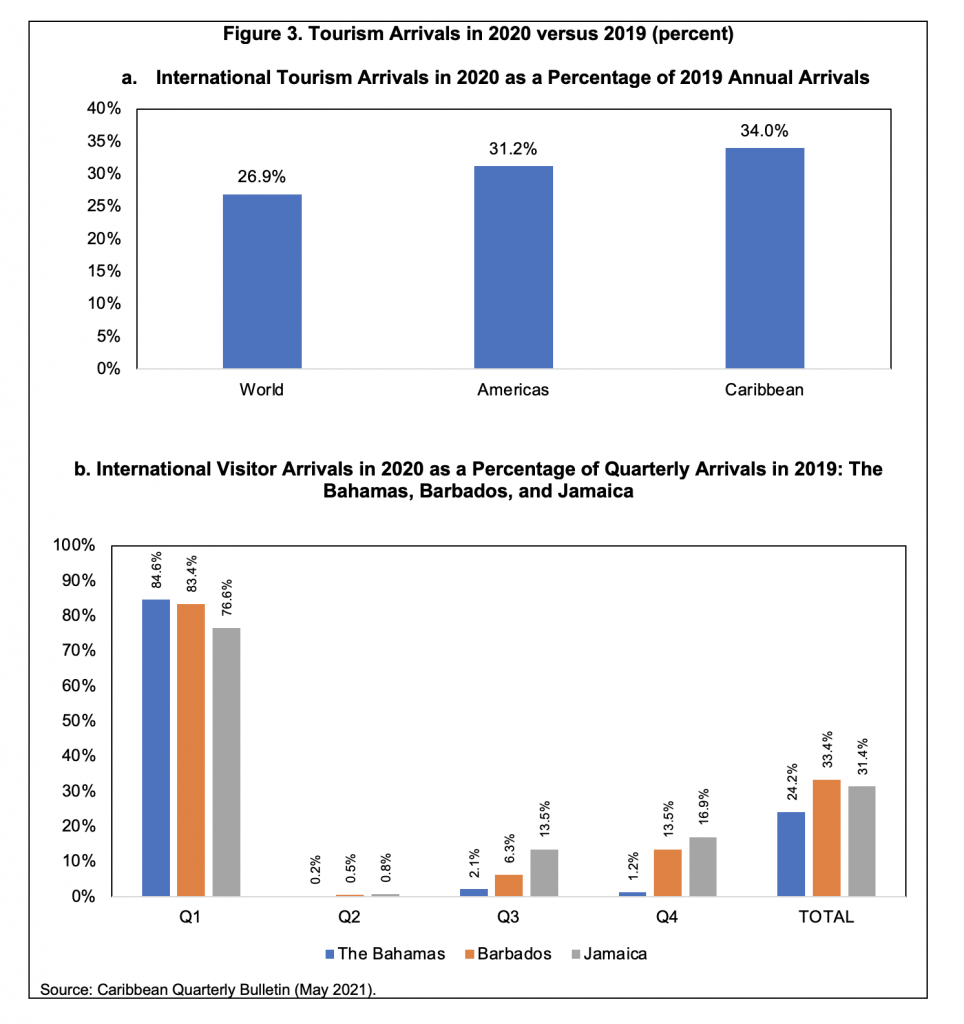

Based on data assembled from various national sources, a breakdown is also now available for tourism arrivals to our three most tourism-dependent economies—The Bahamas, Barbados, and Jamaica (Figure 3). In this context, the first quarter of 2020 saw air and cruise ship arrivals at between 77 and 85 percent of their 2019 levels, followed by a precipitous contraction to near zero arrivals in the second quarter. By the third quarter, arrivals had improved to between 2 and 14 percent of their 2019 same-quarter levels, depending on the country. Overall, 2020 represented a contraction of international visitor arrivals of 76 percent for The Bahamas, 67 percent for Barbados and 69 percent for Jamaica (Figure 3).

Prospects for the future…

As we turn our attention from a devastating 2020, to increasingly bright prospects for the future, determining how quickly demand and conditions for travel will normalize will be crucially important. In this context, our research points to five key considerations that will drive the speed of individual countries’ recoveries:

- The evolution of the pandemic and the vaccine rollout. Clearly this is a key factor affecting people’s willingness to travel.

- Domestic tourism in key source markets. Domestic tourism lurks as a possible substitute for international travel.

- The economic environment in source markets. Here, economic stimulus, particularly in the United States, might help to support the recovery.

- Business tourism versus leisure tourism. In the past, business tourism recovered more gradually from shocks. The nature of the pandemic and boom in remote work might imply a longer lasting impact on this segment.

- Who are your source markets? Demand patterns are poised to change—perhaps dramatically—in the wake of the crisis, but much remains to be determined. These, and other hard-to-anticipate factors underscore the need for improved tourism intelligence systems, that can help governments and industry operators anticipate and adapt quickly to new preferences and behaviors, and to help guide policy design and investment allocation.

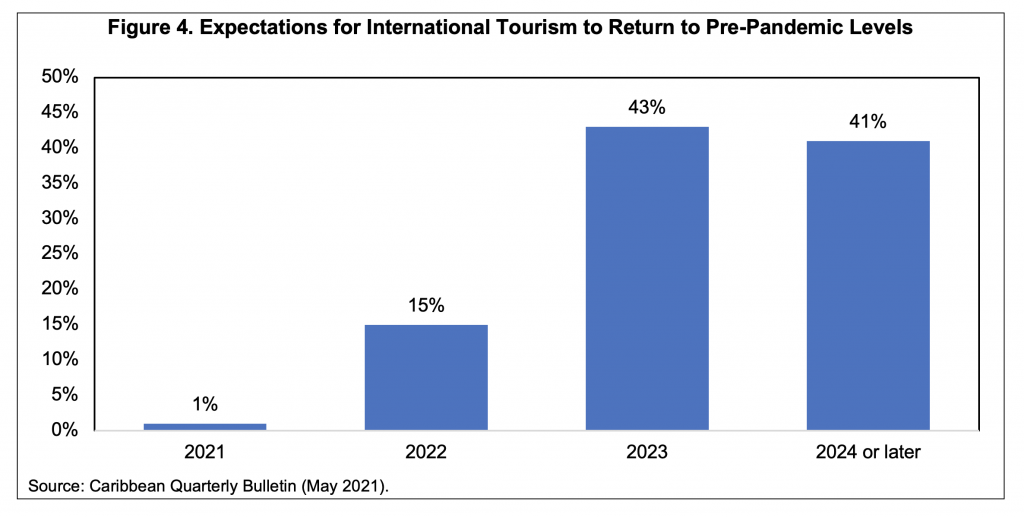

Along these lines, the latest available information regarding expectations for a return of international tourism to pre-pandemic levels suggests that it could still be years before we see a full rebound. On balance, only 15% of experts surveyed by the United Nations World Tourism Organization in late 2020 expected a full restoration of activity globally by end-2022, while a roughly equal proportion of pundits (about 40%) predict that a full normalization of the sector will only materialize by either end-2023 or end-2024 (Figure 4). As highlighted in our publication, the speed of this normalization in key Caribbean countries will depend on source countries and their progress with vaccine distribution, as well as the nature of the tourism product offering in each country, and how both disposable incomes and preferences of consumers in related segments evolve.

Countries can accelerate recovery by taking actions in key areas…

Our report considers factors that will drive economic recovery across the region, some of which are out of the control of Caribbean governments and businesses. Still, countries can do much to support a recovery through policies, investments, and other measures of their own. These include efforts to reinforce tourism intelligence, and to adapt their tourism product offerings to suit a post-pandemic world. Such efforts must also consider changing travel preferences of both traditional and new consumer segments. Within that context, our report details some specific priority areas:

- Safety strategies, with bio-protocols and reopening and closing plans, need to be closely monitored and adjusted to changing circumstances. Communication is key, and cross-country coordination can ensure a common approach and establish a common brand for safe Caribbean destinations.

- Strong market intelligence systems will be more important than ever. These systems should rely not only on traditional statistics, but also on real-time actual travel bookings and tourism expenditure data. Frequent consumer sentiment surveys can also be a useful guide.

- Innovation with respect to demand analysis, safety and security strategies, product distribution, carrying capacity, supply chain efficiencies, and destination management will be key. Innovation and adoption of communication and information technologies at all levels is no longer optional, and cannot be postponed. Adjusting the tourism product to new preferences may be necessary for Caribbean destinations to fully participate in a global recovery of the sector. Analysis of these and related issues will be the subject of future IDB research.

- Preserving and improving access to destinations (particularly via air connectivity) and strategically increasing access to accommodate potential demand growth are going to be very relevant going forward. Analyzing the main market segments of each destination and focusing on prioritizing accessibility for the destination’s main target markets, based on thorough market intelligence analyses, could make all the difference in terms of recovery.

Country Specific Chapters

The report also includes country-specific sections focused on the implications of the crisis for economic performance, as well as policy measures that have been announced and undertaken by governments in The Bahamas, Barbados, Guyana, Jamaica, Suriname, Trinidad and Tobago, as well as the six sovereign member states of the OECS. In the report, our country economists review recent economic performance, policies, and risks to economies in the region.

Podcast

Listen to our podcast on this Quarterly Bulletin below.

Leave a Reply