Are you a business owner who would like to expand operations but find it difficult to get a loan from a bank? Are you an entrepreneur with an innovative idea that has market value but finding someone to invest in your project seems an impossible task? If that is the case, you are not alone! The new issue of IDB’s Caribbean Economics Quarterly covers the topic of finance for firms and provides options for improving access and inclusion.

A well-functioning financial sector is a key element in the development of a competitive private sector in any economy. It not only enables resources from individuals and investors to be channeled to productive ventures, but also decreases transaction costs by providing secure and seamless payment systems that help businesses conduct their operations. Deep and sound financial institutions, as well as broad and cost-efficient access, are desirable elements that spur economic growth and innovation while creating jobs and reducing income inequality and poverty rates.

In Barbados, the financial sector—and in turn the private sector—would greatly benefit from further development, particularly in areas such as financial depth and access to finance for small and medium sized enterprises (SMEs). The IDB is supporting such areas with a US$30 million loan approved in 2021, which has the objective of guaranteeing short-, medium-, and long-term loans to SMEs that were impacted by the COVID-19 shock.

Financial depth is low

Although financial depth in Barbados is higher than that of Caribbean peers, it is still below what is observed for comparable countries outside the region. A common measure of depth is the ratio of private sector credit to GDP. While in Barbados that metric was 80% in 2019, the average for small states reached 95%, and for middle- and high-income countries it stood at 121% and 165%, respectively.

The size and dynamism of stock markets also provide information on depth. While stock market capitalization as a share of GDP is 64% compared to an average of 46% in LAC countries and 79% in middle-income countries, the turnover ratio (trading volume relative to market capitalization) points to a static market. That ratio was 0.2%, significantly below the LAC and middle-income countries ratios of 54% and 169%, respectively.

All commercial banks in Barbados are subsidiaries of foreign entities. Correspondent banking relationship requirements have become more complex in the last decade due to concerns over anti-money laundering and counter-terrorism financing regulations. Unfortunately, complying with international regulations has increased operating costs and lowered the appetite for risk. Moreover, the impact of the pandemic has been severe and commercial banks have reacted by increasing provisions and liquidity to face anticipated increases in non-performing loans, further reducing the availability of funds for lending.

Accessing credit is challenging, particularly for SMEs

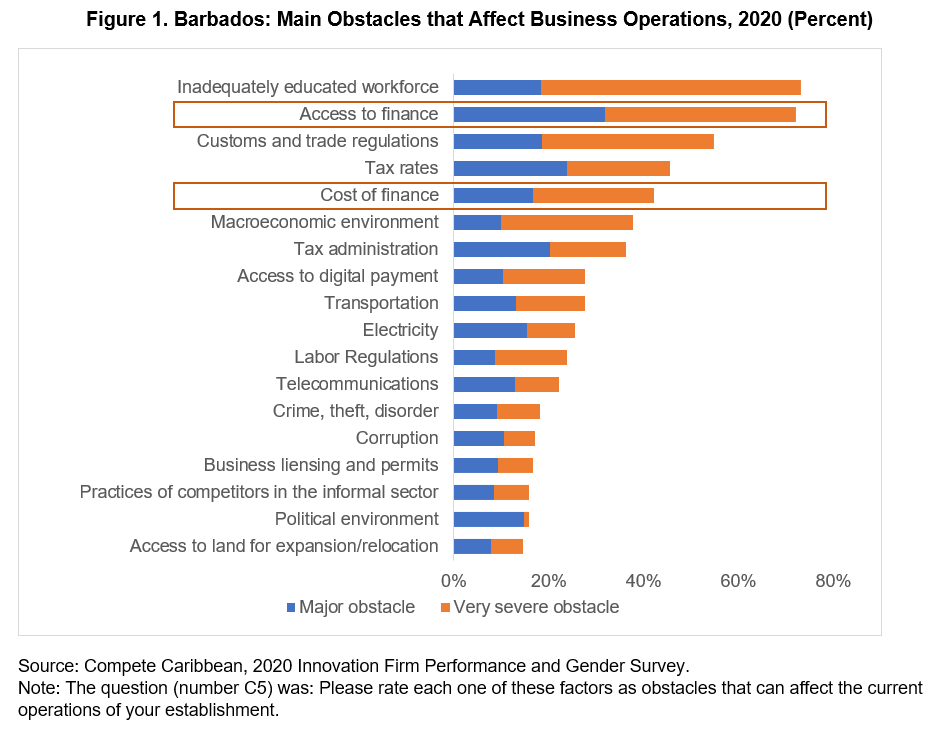

According to Compete Caribbean’s 2020 Innovation Firm Performance and Gender Survey, firms in Barbados considered access to finance and costs to be some of the main obstacles they face when conducting businesses (Figure 1). Access to finance was reported as the second most severe obstacle, after an inadequately educated workforce, and was identified as a major or severe obstacle by 72% of respondents. Cost of financing was reported as being a challenge by 43% of surveyed firms. It is noteworthy that in both cases concerns have increased since Compete Caribbean’s 2014 Productivity, Technology and Innovation in the Caribbean Survey.

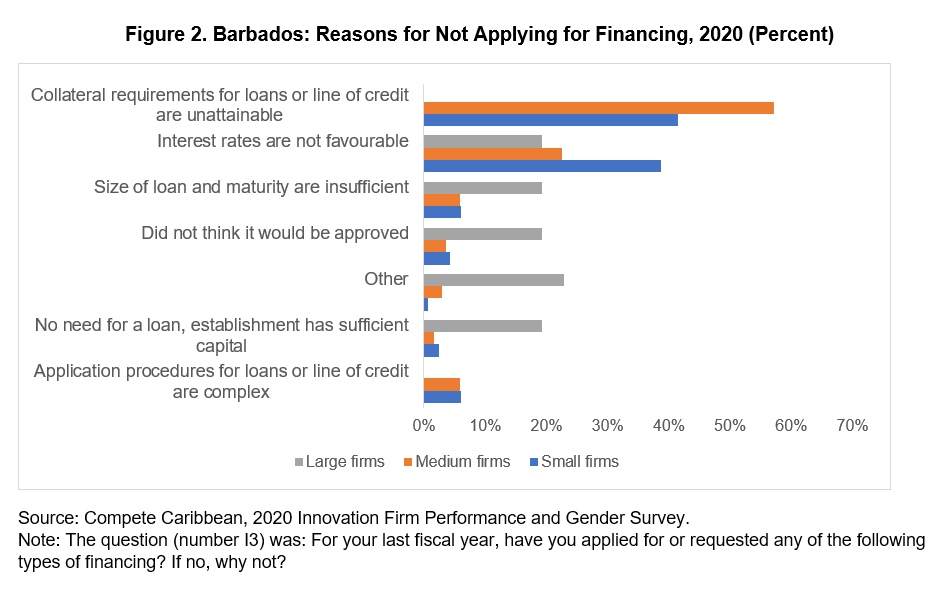

SMEs face even more challenges to accessing credit than large companies. Fewer of them reported having active short-term loans (either a line of credit, an overdraft facility, or a credit card) or medium/long-term loans. The reasons for not applying for loans also vary by size (Figure 2). For both small and medium sized companies collateral requirements are often unattainable and interest rates not favorable. Large companies, meanwhile, also cite high interest rates as a reason, and complain about the size or maturity of the loans not being adequate. Such firms often have enough capital and do not require additional resources to conduct their operations.

The new Fair Credit Reporting Act is a step in the right direction

The lack of easily accessible data to assess the creditworthiness of potential clients translates into stringent know-your-customer requirements and also increases transaction costs associated with performing and adequate due diligence. Barbados passed the Fair Credit Reporting Act in December 2021, which calls for the (i) creation of a regulatory environment to promote the development of a fair credit reporting system, (ii) development of a regulatory framework for the use of such data, and (iii) secure keeping of persons’ private data collected by the credit bureau and related matters. The creation of a credit bureau will have a positive impact on access to financing both for individuals and companies, since financial institutions will have access to information that enables risk assessment. The careful implementation and full operationalization of credit agencies is therefore crucial for the success of this legislation.

In addition to availability of credit information, a strong regulatory framework and well-functioning judicial system is fundamental. The protection of property rights, enforcement of contracts, and fast resolution of insolvency procedures are some features that would lower the risk that financial institutions face when providing loans, and, in turn, would reduce costs. In Barbados, resolution via the judicial system can take years. Improvements on this front will be beneficial. Other reforms and regulations aimed at boosting competition in the credit sector would also have a positive impact.

In conclusion, although the financial sector in Barbados is more developed compared to other Caribbean peers, much work needs to be done to achieve the depth and inclusion observed in other comparable countries outside the region. More dynamic markets as well as easier and more cost-efficient access to credit will allow for resources to flow from those saving to those with great business ideas but that lack financial resources to implement them.

Besides providing funds, the IDB remains committed to unlock the innovation potential in Barbados and the Caribbean by providing technical assistance to entrepreneurs through the Compete Caribbean initiative and IDB Lab.

Leave a Reply