Macroeconomic and fiscal policy is at the brink of a transformative shift due to the integration of artificial intelligence (AI), which is poised to revolutionize fiscal governance and policy formulation in Latin America and the Caribbean (LAC). The technology’s potential to enhance the precision of economic forecasts, optimize budget allocations, and streamline tax administration is immense. However, it also introduces complexities that demand forward-thinking fiscal strategies.

This blog delves into how LAC nations are incorporating AI into their fiscal agendas and the profound implications it holds for their economic development. Furthermore, it offers strategic fiscal recommendations tailored for the LAC region to harness AI’s full potential to improve the effectiveness of such policies.

AI Adoption in LAC

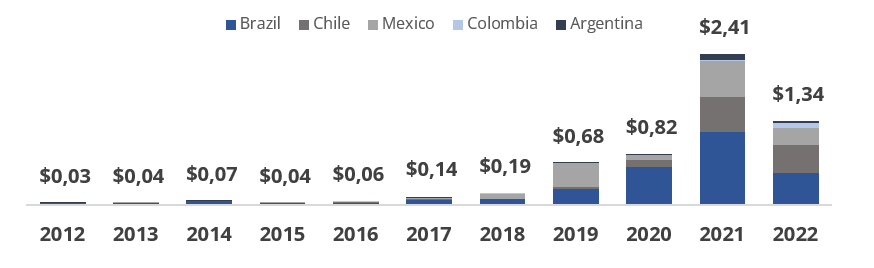

The adoption of AI in fiscal and macroeconomic policymaking is part of a much larger trend. Latin America is witnessing a surge in AI adoption in key economic sectors, particularly in Brazil, Chile, Colombia, Argentina, and Mexico. The significant increase in venture capital investment in AI[1] in these countries highlights this trend.

In nominal terms, Brazil stands out as the regional leader, followed by Chile and Mexico. Colombia and Argentina have shown a promising upward trend in recent years. This increasing adoption of AI in the region demonstrates a growing commitment to AI-driven innovation and technological advancement that could impact economic growth in the long term.

Figure 1. Total Venture Capital Investment in Artificial Intelligence from 2012 to 2022 in LAC5 (USD billions)

Source: Chart elaborated by the authors using data from OECD AI Policy Observatory. https://oecd.ai/

AI Can Improve Economic Decision-making

AI has the potential to increase Latin America’s GDP by over 5.4% ($0.5 trillion) by 2030[2]. This estimate could be even higher if government policies focus on developing digital skills and infrastructure. Sectors such as agriculture, manufacturing, and healthcare are particularly ripe for AI-driven transformation, promising significant economic benefits for the region. Fostering collaboration between government and the private sector will be crucial to maximizing the benefits of AI and ensuring inclusive growth across LAC.

AI also offers significant opportunities for policymakers seeking to improve decision making and optimize resource allocation. One critical area is economic forecasting. By harnessing machine learning[3] algorithms capable of analyzing massive datasets of economic indicators, governments can create more accurate data-driven forecasts.

These models can potentially identify early warning signals of economic downturns, inflation, or fluctuations in employment, providing policymakers with the insight needed for proactive intervention and stabilization measures.

For instance, short-term prediction of key economic indicators using models that exploit high frequency data, known as nowcasting models, have proven highly accurate, aligning closely with official data[4]. These models, powered by machine learning, exceled in predicting complex economic trends, such as the significant GDP declines two IDB member countries faced in 2020: El Salvador and Belize.

The model foresaw a 19.4% GDP drop for El Salvador, closely matching the actual 19.7% drop, and a 23.0% fall for Belize, compared to the reported 23.9% reduction, later adjusted to a fall of 27%. This underscores the effectiveness of AI in economic analysis and fiscal policy planning.

AI Can Improve Efficiency of Tax Administrations

AI also promises to revolutionize tax administration. Tax systems in Latin America and the Caribbean often suffer from inefficiencies, tax evasion, and under-collection. Machine learning algorithms can help tax authorities identify anomalies and patterns that indicate fraudulent activity.

AI-powered systems can streamline tax filing processes, improve compliance, and personalize services for taxpayers, boosting revenue collection and improving the efficiency and effectiveness of tax systems.

In LAC, tax administrations are increasingly integrating AI systems to enhance efficiency and compliance. For example, Brazil’s HARPIA project uses AI for sophisticated risk analysis of tax fraud cases, while Chile’s ITAS has clustering algorithms to categorize VAT taxpayers[5].

By implementing chatbot systems, governments can facilitate communication with citizens and gather valuable data to support well-considered macro-fiscal strategies. For example, the state of Piauí in Brazil, with the support of the IDB and its PROFISCO program, created the chatbot Teresa to assist taxpayers with issues related to state tax payments, declarations, and reporting. Teresa aims to optimize tax services and reduce compliance costs for the state[6].

These examples demonstrate a regional trend towards adopting AI technologies to modernize tax systems and streamline processes, reflecting a commitment to technological advancement in public administration.

AI Can Boost the Efficiency and Effectiveness of Public Spending

Public sector spending is another area ripe for AI-driven optimization. AI can introduce data-driven insights for more evidence-based and transparent budgeting. Algorithms can help identify inefficiencies, prioritize spending according to measurable performance metrics, and reduce wasteful use of public funds. AI-driven procurement processes can also improve fair competition, transparency, and cost-effectiveness for government acquisition programs.

A good example is Colombia’s use of AI to better identify potential beneficiaries for its social programs . By using a Quantile Gradient Boosting model, accurate socio-economic profiles are being generated, enabling improved targeting of social programs and promoting that resources are allocated to those most in need. Such AI-driven systems can be pivotal to reduce waste and improve the effectiveness of government spending in social programs[7].

AI Can Strengthen the Design of Macro-Fiscal Policies

Natural Language Processing (NLP) [8] can be a game-changer for macro-fiscal policy, allowing governments to analyze public sentiment on policies, monitor economic trends through extensive data analysis, and improve policy design and communication.

Analyzing public sentiment on policies can provide valuable feedback to governments. This feedback helps them understand citizens’ perspectives and allows them to adjust communication strategies. By better informing citizens about the benefits and impacts of policies, governments can improve public perception and potentially reduce resistance to reforms.

Machine learning techniques can strengthen macro-fiscal policy design by providing data-driven insights, accurate forecasting of economic indicators, evaluating impacts of proposed measures, identifying structural vulnerabilities, and enabling timely policy responses through continuous monitoring of real-time data. Through simulations and scenario analyses, policymakers can gain insights into the likely outcomes of different policy options, facilitating informed macro-fiscal policy design. The integration of machine learning leads to more robust, evidence-based fiscal policies tailored to complex economic dynamics.

To help government further leverage AI for macro-fiscal policymaking, the IDB launched in 2022 FISLAC(Fiscal Sustainability for Latin American and Caribbean Countries). The platform offers a variety of smart tools to improve the design and implementation of macro-fiscal policies, including the use of machine learning to identify risk thresholds, enabling early detection of potential macro-fiscal challenges.

Challenges: Navigating a Complex Transformation

The lack of widespread telecommunications services and supportive AI digital infrastructure, crucial prerequisites for AI adoption, hinders the potential economic impact in Latin America and the Caribbean and may prevent governments to take full advantage of this technology for policymaking.

This deficiency is slowing down the pace of innovation and diminishing the region’s competitiveness on the global stage, thereby increasing its vulnerability to being outpaced in the adoption of transformative technologies essential for economic growth.

As a result, the potential economic impact of adopting AI in LAC is estimated to be less compared with other regions. By 2030[9], the average impact on GDP in LAC is estimated to be 5.4% ($0.5 trillion), below the estimated 10.6% for European and developed Asian countries. Meanwhile, for China, the impact is significantly higher at 26.1%, and for North America, it stands at 14.5%.

One of the key hurdles to the optimal use of AI in the public sector is the need for capacity building across government institutions. Effective AI implementation demands a workforce that is not only skilled in AI technologies but also possesses domain knowledge relevant to their specific areas of work.

Unfortunately, countries such as Chile, Mexico, and Brazil have experienced a significant exodus of AI talent to more technologically advanced nations, posing a serious challenge for governments in LAC[10].

To address this issue, it is imperative for LAC governments to invest in initiatives aimed at training and retaining their current workforce, while also attracting new talent in data science and AI-related fields. A comprehensive strategy is essential to build the capacity necessary for successful AI adoption.

Responsible and Effective AI Integration in Fiscal Policy

To effectively capitalize on the opportunities presented by AI while mitigating the associated risks, LAC policymakers need to adopt a multi-pronged approach involving legal frameworks, capacity building, and fostering partnerships.

First, governments must prioritize establishing clear guidelines and regulations surrounding the use of AI in macroeconomic and fiscal policy. These regulations should address issues of data privacy, algorithmic fairness, transparency, and accountability. Establishing robust legal frameworks will promote responsible development and deployment of AI solutions, protecting the interests of citizens and safeguarding against potential misuses of the technology.

Unlocking the full potential of AI requires focusing on key investments in crucial areas. Robust infrastructure in telecommunications, technology, and connectivity, alongside upskilling the AI-skilled workforce and retaining domestic talent through competitive incentives, are crucial factors for success. This combined approach empowers societies to reap the benefits of AI.

LAC countries should accelerate implementation of AI in their tax systems to improve compliance, detect fraud, and streamline processes, potentially increasing government revenues. Furthermore, the use of AI in public expenditure management could optimize budget allocations, improve spending efficiency, and direct resources towards priority areas, contributing to economic growth.

Additionally, analyzing unstructured data such as text media, newspapers, social networks, and images could enhance fiscal management and policy decision-making. The use of macro-fiscal virtual assistants could also improve transparency and facilitate decision-making in various institutions like finance ministries, central banks, and fiscal councils by providing real-time data analysis, automating reports and briefings on fiscal and monetary policies, answering queries from policymakers, and identifying potential economic risks and vulnerabilities in economic policies and strategies.

Finally, fostering collaboration between governments, academic institutions, and the private sector holds the key to accelerated progress. Public-private partnerships can leverage the innovation and expertise of technology companies, while research partnerships with universities can drive the development of AI solutions tailored to the specific needs and challenges of LAC economies.

Subscribe to our newsletter to keep yourself updated about our latest publications, blogs and events. Make sure to select newsletters option, after choosing the fiscal policy and management topic.

Learn more about FISLAC.

Related Blogs:

First Year of FISLAC: Transforming Fiscal Sustainability in Latin America and the Caribbean

Brazil Reaps Benefits of Digitizing its Invoices

Virtual Assistance to Taxpayers Allows Tax Administrations to Provide Services During the Pandemic (in Spanish)

Social Media Conversations and Fiscal Reforms: An Empirical Analysis (in Spanish)

[1] Venture capital investment in AI refers to the funding provided by specialized investors to startups and early-stage businesses developing and utilizing artificial intelligence technologies.

[2] PwC’s Global Artificial Intelligence Study: Sizing the prize. (2022).

[3] Machine learning uses data to train models to learn and make predictions without explicit instructions.

[4] Barrios, et. al 2022. Nowcasting to predict economic activity in real time: The cases of Belize and El Salvador. Inter-American Development Bank.

[5] Reyes-Tagle et-al 2023. Digitalization of Tax Administration in Latin America and the Caribbean. Inter-American Development Bank.

[6] El potencial de la inteligencia artificial en la administración tributaria: el caso de los asistentes conversacionales – Gestión fiscal (iadb.org)

[7] See: AI use cases in LAC governments | The Strategic and Responsible Use of Artificial Intelligence in the Public Sector of Latin America and the Caribbean | OECD iLibrary (oecd-ilibrary.org)

[8] Natural Language Processing (NLP) is a field of computer science that helps computers understand and process human language.

[9] See: PwC’s Global Artificial Intelligence Study: Sizing the prize. (2022).

[10] OECD.AI (2024)

Very good article. Thanks!