Suriname is facing a challenging economic outlook. The country’s economy has not recovered from the 2015 recession which was characterized by a large contraction in economic growth, large fiscal and external imbalances, and a rapid increase in central government debt. The effects of the ongoing COVID-19 pandemic are worsening the macroeconomic situation and affecting socioeconomic conditions in the country.

In this blog we summarize the main findings of our recent publication on Economic Institutions for a Resilient Caribbean with reference to Suriname, and note some key fiscal reforms the country needs to recover from the pandemic impacts and grow on a more stronger footing than before.

Growth, fiscal and debt dilemma

A sharp decline in the price of Suriname’s chief export commodities (gold and oil) and cessation of alumina production pushed the economy into a deep recession in 2015. Real GDP contracted by 3.4 percent and 5.6 percent in 2015 and 2016, respectively. An improvement in commodity prices and especially gold production helped return economic growth to positive territory, averaging 1.9 percent in 2017-2019. Nevertheless, the implementation of policies to strengthen the country’s macro-fiscal framework after the 2015 commodity shock was delayed, including the cancellation of an International Monetary Fund (IMF) Stand-By Arrangement (SBA) program. The overhang of the 2015 shock together with inadequate policy buffers, a buildup of macroeconomic risks, and the COVID-19 pandemic pushed the economy into a deep recession in 2020. The IMF estimated that real GDP contracted by 13.1 percent in 2020.

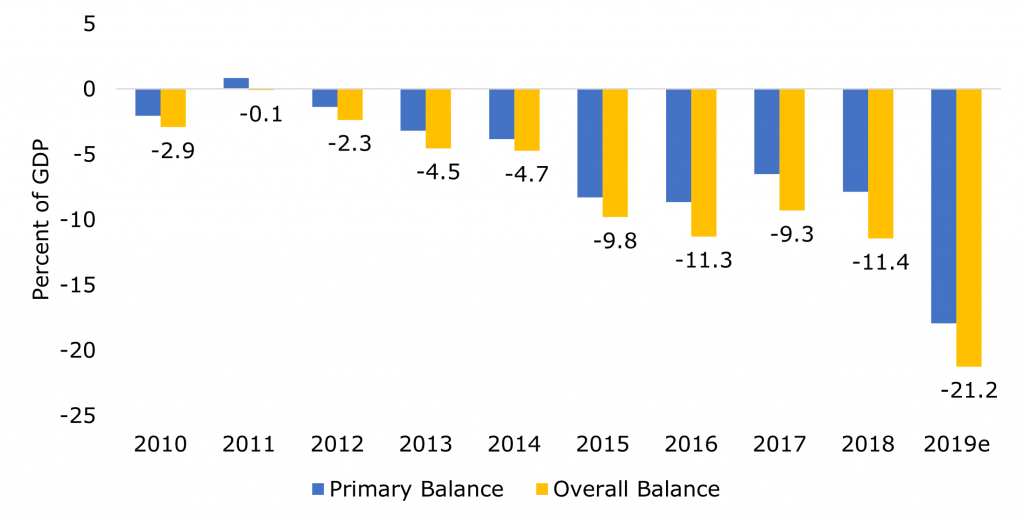

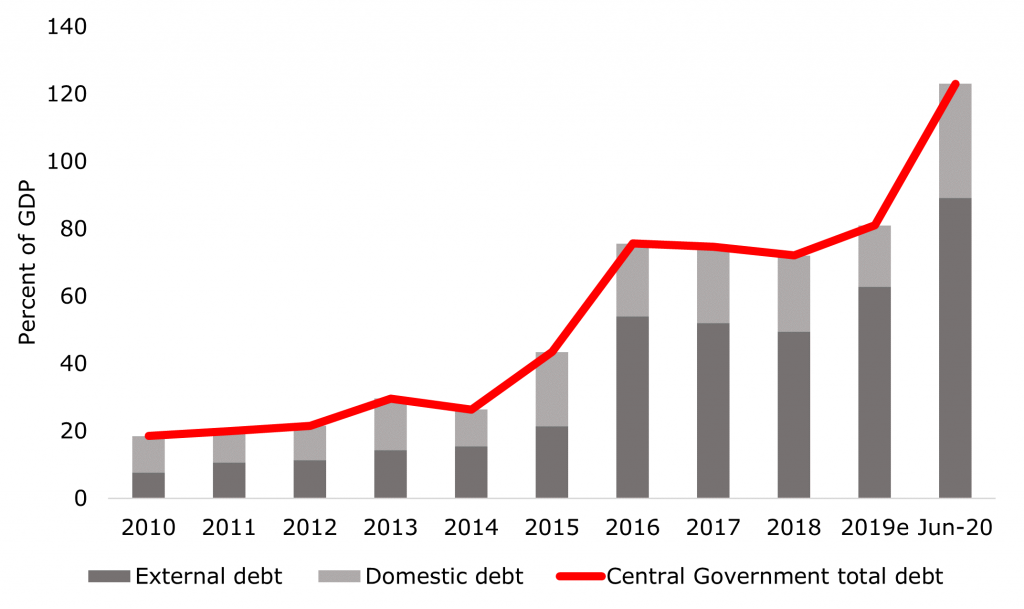

In terms of fiscal policy, Suriname’s fiscal revenues are highly dependent on commodities, and expenditures are largely concentrated in non-discretionary items. In the absence of an adequate policy framework, such conditions make fiscal performance vulnerable to unexpected shocks. Our recent economics bulletin found that for the period 2010-2019, central government revenues averaged 22.4 percent of GDP, with commodities contributing on average 28.7 percent of total government revenues. Central government expenditures over the same period averaged 30.1 percent of GDP, with subsidies and wages and salaries accounting for roughly 60 percent of total government spending. Total expenditure as a share of GDP increased from 24.6 percent in 2010 to 44.6 percent in 2019e. Subsidies are the main contributor to the increase in expenditure: subsidies rose from 4.5 percent of GDP in 2010 to 15.3 percent of GDP in 2019 (Figure 1). In the context of persistent fiscal deficits, exchange rate adjustments and a depressed economy, the debt to GDP ratio significantly increased from 18.5 percent of GDP in 2010 to 123 percent of GDP as of June 2020 (Figure 2).

Figure 1. Fiscal balance

Figure 2. Central government debt

Policy options to support fiscal sustainability. In our recent economics bulletin and book on Economic Institutions for a Resilient Caribbean, we identified the following policy options to return Suriname’s fiscal and debt positions to a sustainable path:

- A. Revenue policy and tax administration: To help improve the country’s public finances, our analysis suggests that the government should consider improving tax and customs administration, implementing a tax reform— including a Value Added Tax, and introducing reforms to reduce tax expenditures. These reforms are important as Suriname’s non-resource taxes to GDP ratio (12-13 percent) is comparatively low, considering the country’s level of per capita income. This could be due to flaws in the tax system design (notably, the absence of a value-added tax) and fundamental shortcomings in tax administration and enforcement. Indeed, an IDB report noted that Suriname’s tax system is characterized by a combination of high tax rates and a complex structure of statutory tax expenditures, incentives, and waivers. Furthermore, the efficiency of tax administration is constrained by limited taxpayer education and service functions, low tax compliance, and an inadequate information technology system. Additionally, tax compliance for direct taxes is low and estimated to be in the range of 40 percent of potential revenue.

- B. Expenditure policies: As discussed above, a significant part of government expenditure has been on non-transparent or inappropriately targeted transfers and subsidies, including electricity subsidies which account for almost 5 percent of GDP. Available studies also point to substantial scope for improving the efficiency of public spending on education and health.

- C. Institutional Framework: The current fiscal framework can be improved to safeguard fiscal sustainability and prevent procyclicality. There is a need to modernize public investment and expenditure management with a focus on public procurement and financial management, enhance fiscal planning and management of fiscal risks by implementing the Savings and Stability Fund, adopting fiscal rules, implementing a credible medium-term fiscal framework, and a debt management strategy. There is also ample room to strengthen the governance framework for state owned enterprises.

Citizen’s trust in public institutions is important to the success of all these public sector reforms. In that regard, transparency and open communication with key stakeholders on policies and reforms could prove to be a key success factor in the country’s strategy to restore inclusive and sustainable economic growth.

Leave a Reply