Latin America and the Caribbean (LAC) suffers from chronically low rates of investment, which hurts economic growth. Since high taxes on corporations disincentivize firms´ investments, an important policy question is whether the region should reduce taxation on corporate profits.

A first step in answering this question is to analyze how high the tax burden is on corporate profits in the region. The Inter-American Development Bank (IDB) and the Organization for Economic Cooperation and Development (OECD) embarked on a research project to answer this question and the findings can be found in the publication Corporate Effective Taxes Rates in Latin America and the Caribbean.

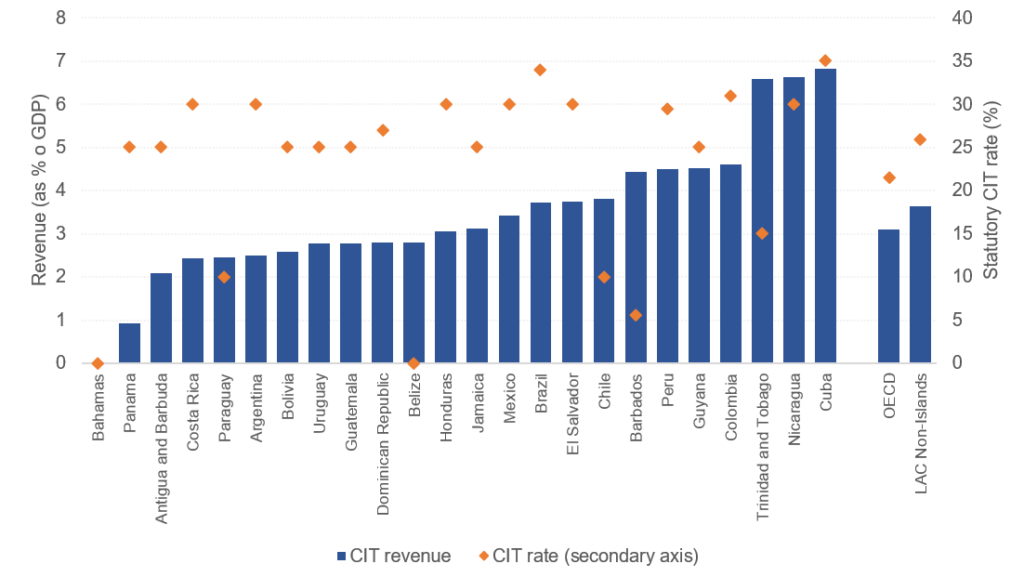

The motivation for the study was that tax burdens on corporate profits in LAC countries are usually perceived as high. This is mainly due to two reasons. First, statutory rates of the corporate income tax (CIT) are high on average. While the average CIT rate is 21.5 percent in the OECD, in LAC it is 25 percent. Second, CIT collections are also high. In 2021, average collections were reached 3.1 percent of GDP in LAC countries, while it reached 2.8 percent of GDP in OECD countries (see Figure 1).

Although the above figures are relevant, they do not reliably reflect the level of effective taxation companies face on their profits.

Figure 1. CIT Revenues and Tax Rates (2021)

Source: Authors’ calculation based on OECD et al. (2023) and Tax Foundation (2022).

Calculating the Effective Tax Rates for 21 LAC Countries

Calculating the effective taxation companies face on their profits requires a detailed analysis of the share of a firm’s total profits that are taxable (e.g. the tax base). How taxable profits are defined is key for this calculation. Taxable profits are not simply defined as the difference between a company’s sales minus its production costs. Its definition also includes numerous tax provisions, such as deductions for the depreciation of assets (i.e., capital allowances), the deduction for the payment of interest on business debt, the valuation of inventory, among others. The higher the generosity of these provisions, the lower the tax base and the effective taxation of firms’ profits.

Having taxable bases and CIT rates, one can then calculate effective tax rates (ETR). In our study, we undertook the task of calculating the ETR on corporate income for 21 LAC countries, using a methodology that allows us to compare them with the 77 jurisdictions included in the fourth version of the OECD’s Corporate Tax Statistics.

How Are Corporate Income Tax ETR Calculated?

The methodology we use simulates the amount of taxes potential investment projects will have to pay in the future. This methodology is usually referred to a forward-looking ETRs. This type of prospective methodology does not require the use of information from tax returns, since the calculations are made based on assumptions about the financial returns of hypothetical investment projects, to which existing tax laws are applied to determine the amount of tax owed.

We calculated two types of ETR:

- The effective average tax rate (EATR), which measures the percentage of profits companies allocate to paying the CIT. This indicator can help policymakers understand whether taxes are influencing companies’ decisions to invest in new projects.

- The effective marginal tax rate (EMTR), which measures the extent to which taxes increase the marginal cost of capital. This indicator can help policymakers understand whether taxes affect company incentives to expand existing investments.

Two aspects of the methodology are worth highlighting. First, the methodology considers the case of a typical company which does not receive any type of preferential tax treatment. This is relevant to mention, as LAC countries tend to have many preferential tax treatments benefiting certain firms and sectors, which reduce ETR on benefited firms.

Second, the ETRs we calculate are compound rates, obtained as a weighted average of ETR for specific combinations of assets and sources of financing. This is an important aspect of the methodology because different tax treatments typically apply to debt-financed projects and equity-financed projects. Similarly, different depreciation tax discounts apply for investments in different types of assets.

How High Are ETR in LAC?

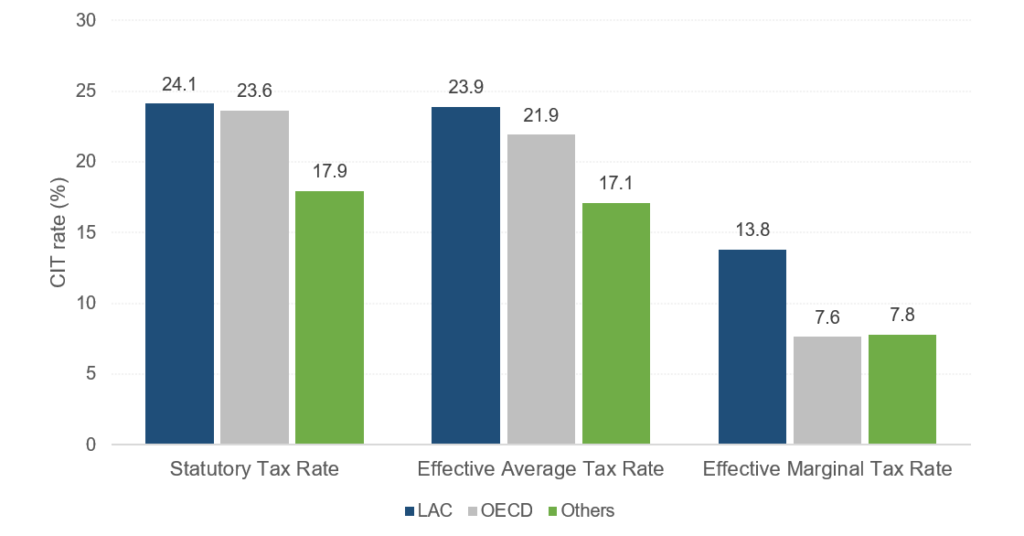

Our study reveals that LAC countries tend to have high average and marginal effective tax rates. In 2021, the average EATR in the 21 LAC countries considered in the study was 23.9 percent, compared to 21.9 percent in the OECD countries and 17.1 percent in the remaining countries analyzed by the OECD (see Figure 2). In the case of EMTR, the average rate was 13.8 percent in LAC, almost double the average of 7.6 percent in the OECD and 7.8 percent in the remaining countries (see Figure 2).

Figure 2. Statutory and Effective Corporate Income Tax Rates, 2021 (country average)

Source: Hanappi, Nieto Parra, Orozco and Rasteletti (2023).

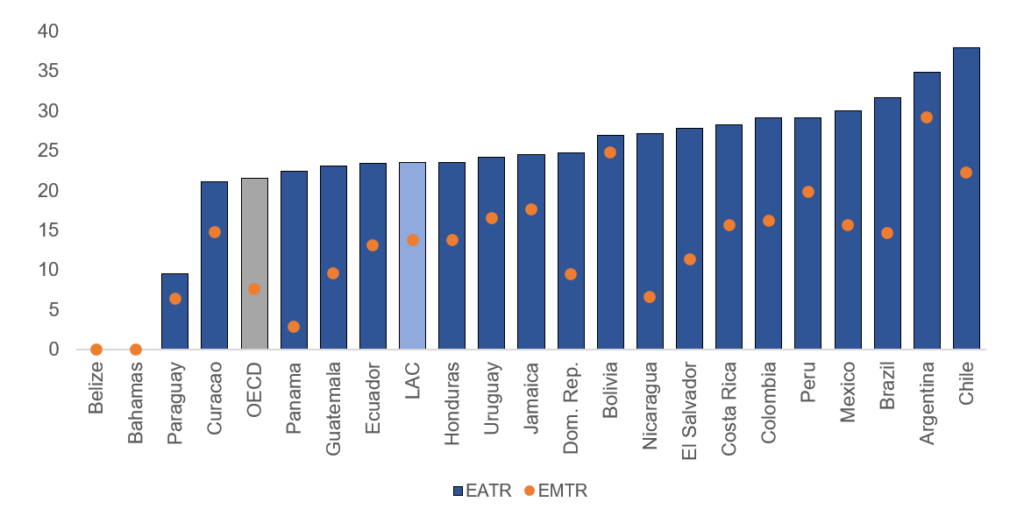

At the individual country level, Argentina, Brazil, and Chile have the highest EATR of the 89 jurisdictions analyzed. Additionally, Colombia, Mexico and Peru are among the ten countries with the highest EATR. In the case of EMTR, Argentina heads the list, and Bolivia, Chile, Jamaica and Peru appear among the top ten (see Figure 3 for LAC countries and Figure 6 of the study, for the 89 jurisdictions considered).

Figure 3. Effective Corporate Income Tax Rates, 2021

Source: Hanappi, Nieto Parra, Orozco and Rasteletti (2023).

The high ETR found for LAC countries are mainly explained by the high levels of statutory corporate income tax rates. However, they are also due in part to ungenerous tax provisions. In fact, the EATR in LAC is on average only 0.2 percentage points (p.p.) lower than statutory rates, while in OECD countries it is on average 1.7 p.p. lower.

A clear example of ungenerous tax provisions is the treatment given to software depreciation in several countries in the region. While the actual annual economic depreciation rate of software is estimated from the literature at 40 percent, the Chilean legislation does not allow software to be depreciated and the depreciation rates allowed in Argentina and Bolivia are very low (2 percent and 5 percent, respectively).

What Should Latin American Countries Do With Their Corporate Income Taxes?

Given the fact that each country in the region has a different fiscal position and taxation structure, it is impossible to provide a one-size-fits-all recommendation for all of LAC.

It is worth highlighting that although our study indicates that the effective tax rates on business profits in most Latin American countries are among the highest in the world, this does not imply cutting them should be a policy priority now. While there are different reasons to suggest this caution, two are particularly important in the current context: the region’s fiscal situation and the ongoing international debate about a global minimum corporate income tax.

Many countries in the region currently have high levels of public debt and many are implementing fiscal consolidation processes. Completing these processes is of vital importance because a stronger fiscal stance can bolster investor sentiment and reduce their perception of risk in the region. This may lead to lower interest rates and inflation, which in turn reduce effective tax rates in the region.

Cutting statutory corporate income tax rates may also not be wise at the moment, as many countries around the world are currently adjusting their corporate income taxes to align them to the two-pillar solution to address the tax challenges arising from the digitalization of the economy. In particular, the second pillar of this solution considers the introduction of a global minimum tax. The introduction of such provision could lead several countries to increase their ETR on large corporations, which will make the region’s tax systems relatively more competitive.

Finally, although we recommend acting with caution before reducing statutory corporate income tax rates, this does not mean that there are no opportunities to review other aspects related to corporate taxation. In particular, the introduction of a global minimum tax presents an opportunity for LAC countries to review existing tax expenditures aimed at attracting investments from large corporations. These tax expenditures will lose attractiveness if most countries introduce a global minimum tax, as establishments paying little taxes in countries in the region will have to pay higher taxes in the countries of the parent corporations. Tax expenditures that are deemed ineffective should then be eliminated.

As fiscal consolidation programs advance and with more clarity on international taxation rules, countries could consider reforming their corporate tax provisions to reduce distortions and foster more investment and growth. These reforms could make capital allowances more generous and also include fiscally responsible reductions in statutory corporate income tax rates that do not compromise the sustainability of public finances.

Download the paper: Corporate Effective Tax Rates in Latin America and the Caribbean

Subscribe our newsletter, to keep yourself updated about our latest publications, blogs and events. Make sure to select newsletters option, after choosing the fiscal policy and management topic.

Related blogs:

Advances in the new international taxation and challenges for Latin America and the Caribbean

The Impact of International Trade and BEPS Commitments on Tax Incentives and Collection

How can tax Policy Promote Investment in the Post-Pandemic Period?

Leave a Reply