With the outbreak of the pandemic, fiscal balances in Latin America and the Caribbean (LAC) deteriorated and public debt increased significantly. When combined with the expected slowness of economic recovery, this will put significant pressure on the sustainability of public finances for countries in the region. Given this scenario, these countries urgently need to develop and implement a fiscal strategy to reactivate their economies and foster inclusive growth, while at the same time ensuring fiscal sustainability to avoid falling into a debt trap.

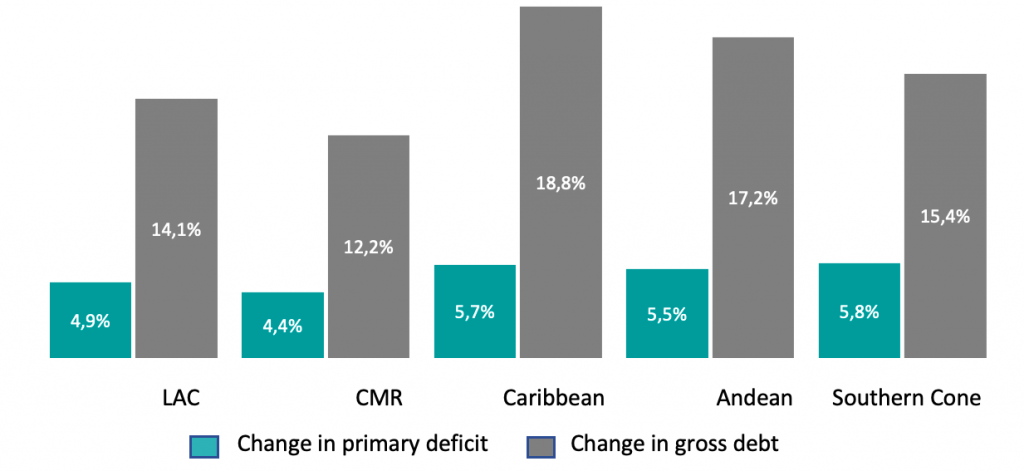

The pandemic had a strong impact on the public finances of LAC countries. In 2020, primary deficits increased by 5pp of GDP in emerging countries, due to higher spending and lower tax revenues. In turn, these deficits, the decline in economic activity, and the depreciation of the region’s currencies caused debt as a percentage of GDP to increase by 14pp.

Change in primary deficit and gross debt, 2019-2020 (% of GDP)

The increase in the primary deficit was mainly a result of the increase in public spending, as the countries in the region made unprecedented efforts to address the health and social crisis caused by the pandemic. The countries in the region announced measures equivalent to 8.5% of GDP, of which 3.4pp were in the form of additional spending, according to the IDB’s 2021 Latin American and Caribbean Macroeconomic Report. These financial resources were used to support the health sector in addressing the health emergency, and to provide needed liquidity for households and companies.

At the regional level, the Andean Region and Southern Cone made the greatest effort, announcing measures to address the pandemic amounting to 12% and 9.3% of GDP, respectively. In addition, the Caribbean countries announced measures in the amount of 5.7% of GDP, while in Central America, Mexico and the Dominican Republic (CMR) the amount was 5% of GDP. It is worth noting that approximately 60% of these additional expenditures were made in 2020, meaning that in most countries, implementation will continue during 2021.

On the tax revenue side, the negative impact of the pandemic was both a result of the enormous contraction of economic activity and the tax relief measures introduced to increase the liquidity of households and businesses. As a result of both factors, average tax revenue among these countries fell by 2.2% of GDP in 2020.

Fiscal Results: Slow Return to Pre-COVID Levels

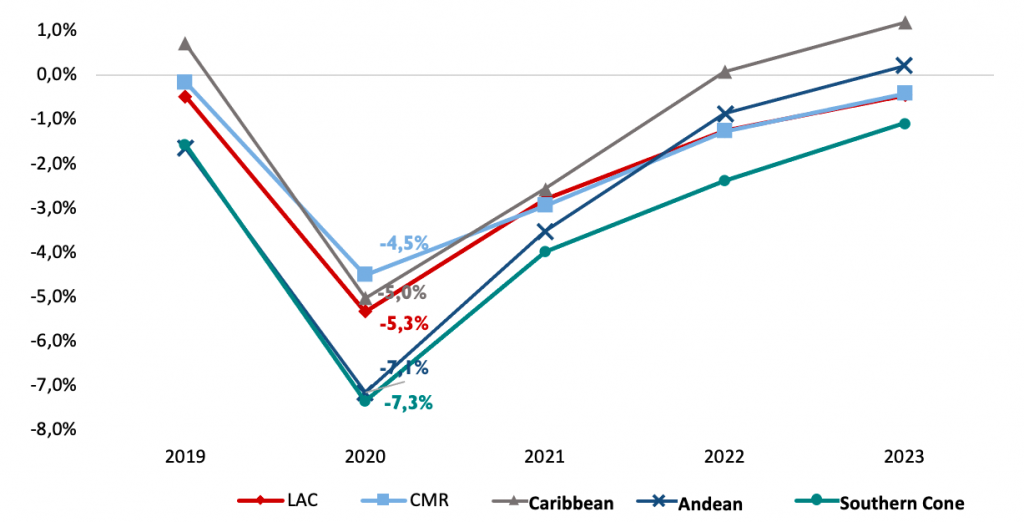

Returning to the level of fiscal results recorded prior to the pandemic will be a slow process. In 2021, fiscal results will depend on the dynamics of vaccination, since this will determine the reopening and reactivation of the economy, and influence expectations of a return to normal. Both aspects are crucial for increasing tax revenues and reducing pressures on public spending.

Despite the importance of vaccination, the rate of vaccinations in LAC is currently much lower than in other countries, such as the United States, the United Kingdom and Israel, which have administered 40, 47 and 115 vaccines per 100 inhabitants, respectively[1]. In the region, only Chile stands out for having the highest total number of vaccines per 100 inhabitants (49), surpassing the rate of countries such as the United States and the United Kingdom. The low vaccination rates are a consequence of the various difficulties countries have faced due to the complexities of vaccine provision, distribution, and prioritization. This dynamic creates an important fiscal challenge for these countries, which face pressure to extend fiscal support programs for the duration of the vaccination process, slowing down the recovery of their fiscal balances.

In addition to vaccination, the possibility of consolidating public finances will depend on the evolution of economic growth and employment. According to our estimates, primary fiscal balances should return to the levels observed before the pandemic by 2023.

Nevertheless, this return to pre-pandemic deficit levels will look different in the various LAC regions. CMR, despite being the region with the lowest primary deficit in 2020, is expected to experience a slower return to pre-pandemic debt levels, a consequence of the high fiscal imbalances recorded before the shock. In contrast, the Andean countries, which closed 2020 with one of the largest primary deficits (7.1% in GDP), are expected to have a faster recovery rate, thanks to the projected recovery in commodity prices.

Primary balance by regions (% GDP)

Public debt will remain high in the medium term

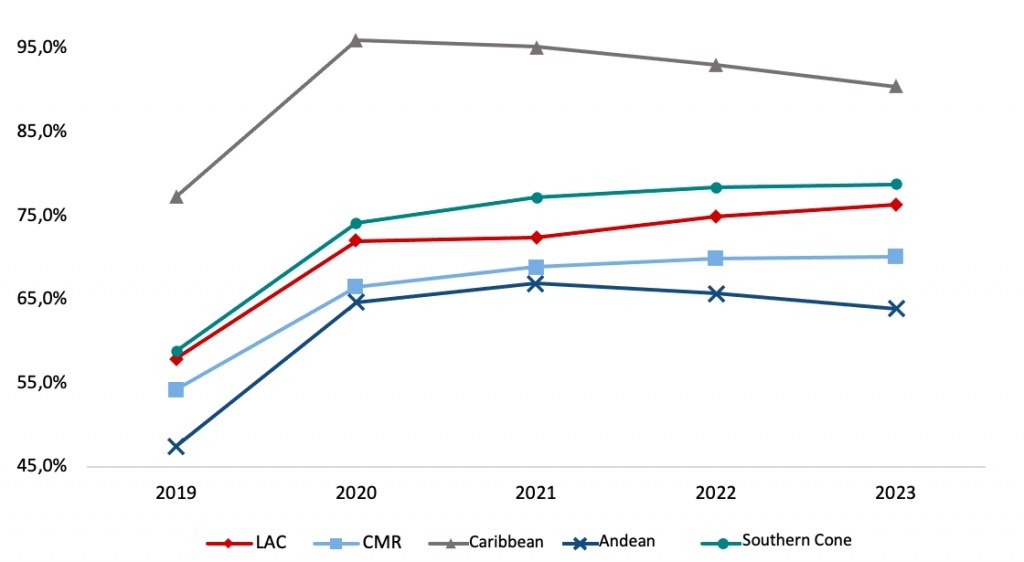

As a result of the dynamics of the fiscal deficit and economic activity, public debt levels are expected to remain higher than they were at the end of 2020, with no return to pre-pandemic levels expected in the medium term.

As mentioned earlier, LAC public debt increased by 14pp in 2020. However, results varied within the region. For example, the Caribbean countries recorded the highest debt increase (21pp of GDP), due to steep currency devaluation and the drop in economic growth during the crisis. The rise in debt was not as severe in CMR (12pp of GDP), due to a lower fiscal imbalance and fewer exchange rate fluctuations.

Over the next few years, the region is expected to continue recording higher debt levels, equivalent to approximately 74.5% of GDP on average. In 2021, only the Caribbean countries are expected to reduce their debt levels, thanks to the large primary surpluses they recorded prior to the pandemic.

Gross debt by region (% GDP)

High debt servicing will put pressure on sustainability

Despite the abundance of international liquidity, which could reduce the cost of financing, the expected dynamics of public debt will increase debt services. This will create significant pressure on the sustainability of the region’s debt, given its countries’ limited payment capacity.[2]

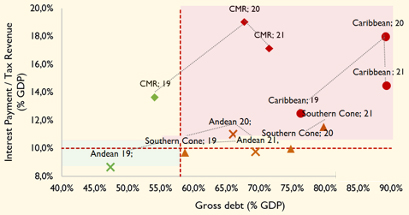

A simple way to analyze the increase in debt pressure on fiscal sustainability is to analyze two indicators simultaneously: debt as a share of GDP and interest payments as a percentage of tax revenue. Although an increase in both indicators can be observed in all countries, the changes in 2020 and the dynamics for 2021 are different.

The CMR and Caribbean regions recorded the greatest increases in debt service. In the case of CMR, the countries of this region already allocated a significant percentage of their tax revenues to paying interest on the debt before the pandemic, making the new increase especially risky. The situation is similar in the Caribbean countries, although in their case debt increased by much more, taking them to very high levels of indebtedness.

The Southern Cone, which has maintained relatively high debt levels, did not suffer a sharp increase in interest payments, partly because of a debt restructuring in Argentina and the accommodative monetary policy adopted by most of its countries. T[RN1] hese countries have benefited from low inflation that has lowered their cost of financing, given their more developed local debt market. The Andean countries, for their part, while experiencing a significant increase in debt and interest payments, had the advantage of starting from a relatively favorable economic situation.

In 2021, better indicators are expected for interest payments in most LAC regions, except for the Southern Cone. At the same time, however, the debt burden will continue to increase in most regions excluding the Caribbean. These dynamics in 2021, and the results observed in 2020, suggest that both indicators will be much higher than the levels observed prior to the pandemic in all regions, indicating greater fiscal vulnerability.

Debt and gross debt accessibility

Debt dynamics: Almost at the limit

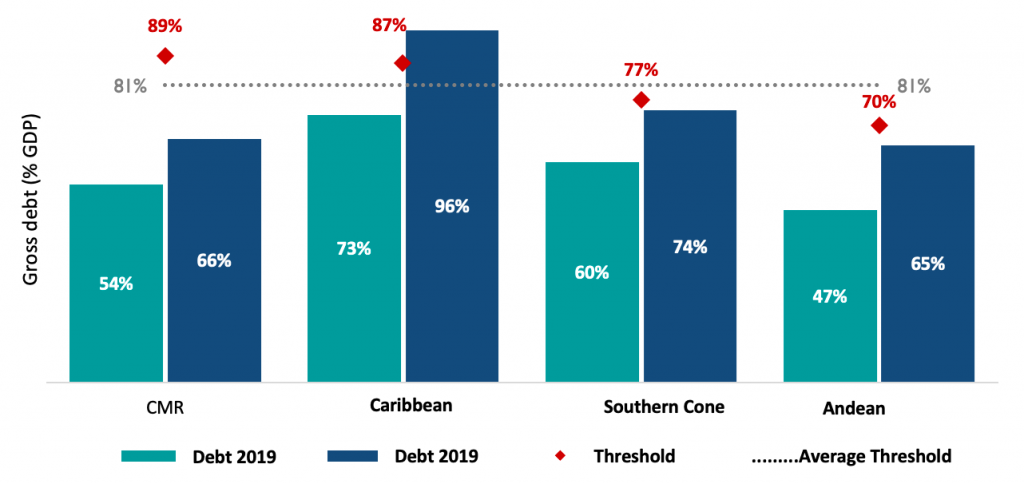

Another way to analyze the regions’ risk of fiscal sustainability is by comparing current levels of indebtedness with “debt limits that ensure[RN2] fiscal solvency.” To this end, we have used a methodology developed by Gosh et al (2013)[3] to estimate the debt capacity of sub-regions. Debt thresholds vary between regions, depending on their structural characteristics and fiscal records.

Our analysis shows that, due to the pandemic, the Caribbean countries have already exceeded the prudential debt limit, while the countries of the Southern Cone and the Andean Region are close to this limit and could exceed it in 2021. Only in the CMR countries the debt is well within the prudential level.

Borrowing limits and fiscal room[4]

To prevent high levels of indebtedness from generating episodes of debt overhang,[5] countries must create a fiscal strategy that promotes growth, while at the same time advancing the consolidation of public finances. The following are some ideas to consider in this regard.

Pro-growth fiscal strategy during the recovery

In the short term, fiscal policy must be conducive to accelerating the post-pandemic transition and reactivating economies.Given that contagion rates remain high in many countries in the region, fiscal policy must continue to support the health sector to address the newly infected and accelerate vaccination campaigns, allowing for a faster return to normal.

During this transition period, it will be important to review and adapt the support measures for families and businesses introduced in the early phases of the pandemic to ensure they address the workers and firms that need help the most. Support that is no longer needed should be discontinued, freeing up resources to fund measures that have a high impact on the recovery of economic activity.

Once a sustainable economic reactivation has been achieved, governments should take steps to address their fiscal situation. A main priority will be to reallocate public spending to eliminate superfluous expenses, reduce leaks in the transfer and subsidy systems, combat corruption in public purchases, and bring public sector salaries in line with private ones.

These measures will help reduce inefficiencies in public spending, which, according to an IDB study, accounted for approximately 4.4% of GDP in 2018.[6] Likewise, it will be important to improve the management of public investment to achieve a better selection and implementation of projects. The quality of social spending should also be improved, leading to an effective accumulation of human capital, particularly among low-income households. Improvements in the accumulation of physical and human capital would provide a sustainable economic stimulus and help consolidate the fiscal situation in the various countries.

In addition to improving the efficiency of public spending, the region must improve its revenue management, prioritizing measures that reduce evasion and eliminate special tax treatments. Before the economic crisis, the region was already characterized by ineffective tax systems, with high levels of evasion and high tax expenditures that favor high-income households.[7] Specifically, evasion of the consumption and income tax averages more than 6% of GDP in LAC, while tax expenditures decrease effective tax collection by another 3% of GDP.[8] Reducing tax expenditures and evasion will allow countries to accumulate more resources and make progress toward simplifying their systems.

As well as reducing tax evasion and spending, tax and public spending policies should seek to encourage formality. In a recent blog , specialists from the IDB’s Fiscal Management Division[9] stressed that, now more than ever, it is crucial to propose reforms that promote the recovery of formal employment in LAC, particularly among low-income workers, since informality affects them more strongly. We recommend rethinking and redesigning taxes on work and social programs to introduce assistance for formal work (“formal workfare”) that rewards workers in the formal sector, instead of social assistance (“welfare”) that punishes these workers.

The recommended redefinitions of public revenues and expenditures must be accompanied by an effective management of public debt and a strengthening of fiscal responsibility. In terms of public debt management, countries with a large amount of debt coming due in the short term must define and implement strategies to reduce these pressures. Debt service for the next few years is estimated to be approximately 5% of GDP, equivalent to what countries spend on average on education, or even 25% of their public investment spending. Therefore, an active debt management policy is essential to minimize liquidity and solvency risks and generate the necessary space for public investment. Also important is reinstating and strengthening mechanisms to increase fiscal responsibility.[10] To this end, reinstating and recalibrating fiscal rules will be vital after the pandemic. Such debt management and fiscal responsibility measures will make it possible to minimize liquidity and solvency risks.

To summarize, the pandemic has increased fiscal deficits and debt problems in our region. Nevertheless, LAC still has ample room to implement a fiscal policy that stimulates economic recovery and reduces the risk of falling into a debt trap. Government actions in the coming months will be decisive in ensuring that the ’20s are not a lost decade.

[1] Our World in Data, March 25, 2021

[2]Cardenas, M., Ricci, LA, Roldos, J., & Werner, AM (2021). Fiscal Policy Challenges for Latin America during the Next Pandemic Stages: The Need for a Fiscal Pact (No. 2021/077). International Monetary Fund.

[3]Gosh, AR, Kim, JI, Mendoza, EG, Ostry, JD, Quereshi, MS (2013): Fiscal Fatigue, Fiscal Space and Debt Sustainability in Advanced Economies. Economic Journal, vol. 123, February 2013, iss. 566, pp. F4 – F30 and Technical Appendix pp. 1–8.

[4]Based on the methodology of Gosh et al (2013)

[5]Debt overhang occurs when the debt burden is so great that an entity or economic agent cannot assume additional debt to finance future projects.

[6]Izquierdo, Pessino and Vuletin (2018)

[7]CIAT (2018). Panorama de los Gastos Tributarios en América Latina: principales estadísticas de la Base de Datos del CIAT. Dirección de estudios e investigaciones tributarias.

[8]ECLAC (2020). Panorama Fiscal de América Latina y el Caribe.

[9] Now it is the time to Foster Labor Formalization in Latin America and the Caribbean by Carola Pessino – Emilio Pineda – Alejandro Rasteletti -ValentinaAlarcon- Recaudando Bienestar March 2021

[10]Cardenas, M., Ricci, LA, Roldos, J., & Werner, AM (2021). Fiscal Policy Challenges for Latin America during the Next Pandemic Stages: The Need for a Fiscal Pact (No. 2021/077). International Monetary Fund.

Leave a Reply